new capital gains tax plan

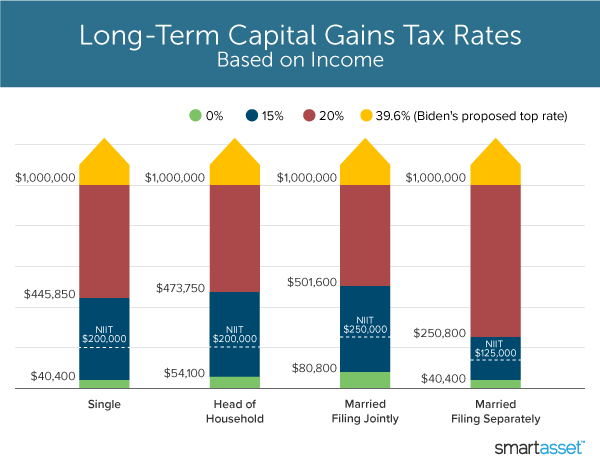

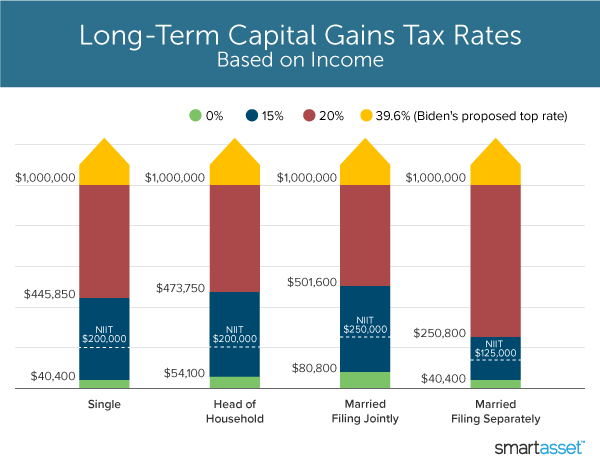

Democrats also want to increase the top tax rate on individuals making. Taxable income of up to 40400.

Joe Biden Tax Plans Proposals Tax Foundation

So for 2018 through 2025 the tax rates for higher-income people who recognize long-term capital gains and dividends will actually be 188 15 38 for the NIIT or 238 20 38 for the NIIT.

. In addition to raising the top individual income-tax rate on those who make 400000 or more to 396 from 37 Biden has proposed raising the long-term capital gains tax and the dividend rate tax. Under this proposal the 396 capital gains rate would apply to long-term and short-term gains as well as dividends. Based on the Tax Foundation General Equilibrium Model we estimate that on a conventional basis Bidens plan would increase federal tax revenue by 333 trillion between 2021 and 2030 relative to current law.

Rates for Trusts and Estates. Biden proposes raising the long-term capital gains tax bracket from 20 to 396 for anyone earning more than 1 million per year. Increasing the corporate tax rate to 28 percent would account for the largest revenue gain about 1 trillion over 10 years in the plan.

For taxpayers with income above 1. Smart taxpayers will start. This tax only applies to individuals.

Currently all long-term capital gains are taxed at 20. Raising Long-Term Capital Gains Tax Rates for High-Income Earners. 2021 Long-Term Capital Gains Tax Rates.

The new tax law also retains the 38 NIIT. What Changes Will Biden Make to the Capital Gains Tax. All Major Categories Covered.

Select Popular Legal Forms Packages of Any Category. Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well. It would apply only to taxpayers whose adjusted gross income exceeds 1 million the top 03 of taxpayers.

The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. Americans are facing a long list of tax changes for the 2022 tax year. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners.

And only the portion of income or gains over 1 million would be taxed at the top 396. Tax Changes and Key Amounts for the 2022 Tax Year. Democrats Seek Backup Plan on Taxing Capital Gains Alternative sought after President Bidens proposal to limit the tax-free step-up basis runs into opposition Budget reconciliation may offer.

When including the net investment income tax the top federal rate on capital gains would be 434 percent. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Connect With a Fidelity Advisor Today.

2021 federal capital gains tax rates The tables below show marginal tax rates. This means that different portions of your taxable income. Under the new rule those who own 300 million won 260000 worth of shares down sharply from the current 1 billion won.

The increase in the capital gains tax is one of several revenue-raising measures that Democrats are planning to introduce. Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad If youre one of the millions of Americans who invested in stocks.

The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income. Heres how the House Democrats plan could push that rate to 318 for some investors. For taxpayers over the 1M income threshold this results in their marginal tax rate on capital gains going from 238 under our current system 20 highest capital gains rate 38 NIIT to 434.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. Urban Catalyst is a leader in QOZ investing. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property -- at 25 up from 20. Biden Adds New Tax on Wealthy to 58T Budget By Justin Sink and Erik Wasson Analysis March 28 2022 at 1028 AM Share Print What You Need to Know The plan calls for a minimum 20 tax rate on. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets.

A heated debate is happening between stock market players and members of the political community over the financial authoritys recent decision to sharply lower standards for large shareholders subject to capital gains tax. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. President Biden wants to end this Trump Administration policy which could greatly affect your tax strategy as a real estate investor.

Tax filing status 0 rate 15 rate 20 rate.

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Money Isn T Everything Capital Gain

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Capital Gains Tax

2022 Capital Gains Tax Rates In Europe Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Can Capital Gains Push Me Into A Higher Tax Bracket

Understanding Taxes And Your Investments

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)